Top Life Insurance Companies in the World:

1. MetLife: MetLife is a leading provider of life insurance and financial services, with a long history of serving customers around the world. They offer a variety of life insurance products, including term life, whole life, and universal life policies.

2. Prudential Financial: Prudential Financial is another top life insurance company that offers a range of products to meet the needs of customers. They are known for their excellent customer service and financial stability.

3. New York Life: New York Life is one of the largest mutual life insurance companies in the world, with a strong reputation for financial strength and stability. They offer a variety of life insurance products, including term life, whole life, and universal life policies.

4. Northwestern Mutual: Northwestern Mutual is a top life insurance company that has been providing financial security to customers for over 160 years. They offer a variety of life insurance products, as well as financial planning services to help customers achieve their financial goals.

5. AIG: AIG is a global insurance company that offers a range of life insurance products to customers around the world. They are known for their financial strength and stability, making them a top choice for customers seeking life insurance coverage.

Top Insurance Companies:

1. State Farm: State Farm is one of the largest insurance companies in the United States, offering a range of insurance products, including life insurance. They are known for their excellent customer service and affordable rates.

2. Allstate: Allstate is another top insurance company that offers a variety of insurance products, including life insurance. They are known for their strong financial stability and commitment to customer satisfaction.

3. Geico: Geico is a well-known insurance company that offers a range of insurance products, including life insurance. They are known for their affordable rates and easy-to-use online platform.

4. Farmers Insurance: Farmers Insurance is another top insurance company that offers a variety of insurance products, including life insurance. They are known for their personalized service and competitive rates.

5. USAA: USAA is a top insurance company that specializes in serving military members and their families. They offer a variety of insurance products, including life insurance, with a focus on customer service and financial stability.

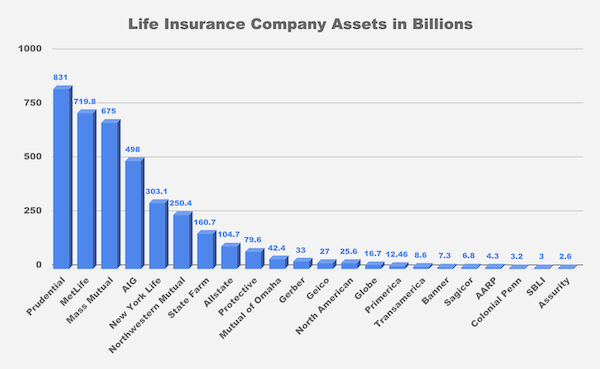

Largest Life Insurance Companies:

1. MetLife: MetLife is one of the largest life insurance companies in the world, with a strong presence in the United States and around the globe. They offer a variety of life insurance products to meet the needs of customers.

2. Prudential Financial: Prudential Financial is another large life insurance company that is known for its financial strength and stability. They offer a range of life insurance products, including term life, whole life, and universal life policies.

3. New York Life: New York Life is one of the largest mutual life insurance companies in the world, with a long history of serving customers. They offer a variety of life insurance products, as well as financial planning services.

4. Northwestern Mutual: Northwestern Mutual is a large mutual life insurance company that has been in business for over 160 years. They are known for their financial strength and stability, making them a top choice for customers seeking life insurance coverage.

5. AIG: AIG is a global insurance company that is one of the largest providers of life insurance in the world. They offer a range of life insurance products to meet the needs of customers.

Types of Life Insurance:

1. Term Life Insurance: Term life insurance provides coverage for a specific period of time, such as 10, 20, or 30 years. It is the most affordable type of life insurance and is a good option for young families or individuals on a budget.

2. Whole Life Insurance: Whole life insurance provides coverage for your entire life, as long as you continue to pay the premiums. It also includes a cash value component that grows over time, providing a savings element.

3. Universal Life Insurance: Universal life insurance is a flexible type of life insurance that allows you to adjust your premiums and death benefit as needed. It also includes a cash value component that grows over time.

4. Variable Life Insurance: Variable life insurance allows you to invest the cash value component of your policy in the stock market. It offers the potential for higher returns, but also comes with more risk.

5. Survivorship Life Insurance: Survivorship life insurance covers two lives, typically husband and wife, and pays out a death benefit after both insured parties have passed away. It is often used for estate planning purposes.

In conclusion, choosing the right life insurance company and policy is an important decision that can provide peace of mind for you and your loved ones. Whether you are looking for term life, whole life, or universal life insurance, there are many top companies to choose from that offer the financial strength and stability you need. By doing your research and comparing quotes, you can find the right life insurance policy to protect your family’s future.

FAQs:

Q: How much life insurance coverage do I need?

A: The amount of life insurance coverage you need depends on your individual financial situation, including your income, debts, and future expenses. A good rule of thumb is to have enough coverage to replace your income for several years and pay off any debts.

Q: How do I choose the right life insurance policy?

A: To choose the right life insurance policy, consider your financial goals, budget, and coverage needs. Compare quotes from multiple insurance companies and consider working with a financial advisor to help you make an informed decision.

Q: Can I borrow money from my life insurance policy?

A: Depending on the type of life insurance policy you have, you may be able to borrow money from the cash value component of your policy. Keep in mind that borrowing money from your policy can affect your death benefit and may incur interest charges.

Q: What happens if I stop paying my life insurance premiums?

A: If you stop paying your life insurance premiums, your policy may lapse and you will lose coverage. Some insurance companies offer a grace period to reinstate your policy, but it is important to stay current on your premiums to maintain coverage.

Q: Is life insurance taxable?

A: In most cases, life insurance death benefits are not taxable to the beneficiaries. However, if you cash out a life insurance policy or borrow from the cash value, there may be tax implications. It is recommended to consult with a tax professional for personalized advice.

Life Insurance Agent Explains: How We Choose Life Insurance Companies | Wealth Nation

Keywords users search for: good life insurance companies Top life insurance companies in the world, Top insurance companies, Top insurance companies in the world, Largest life insurance companies, Types of life insurance, Life insurance, Permanent life insurance, Term life insurance

Images on topic good life insurance companies

Category: Top 18 Good Life Insurance Companies

Read more here: kotop2.dienbienfriendlytrip.com

:max_bytes(150000):strip_icc()/dotdash-INV-best-life-insurance-companies-48458581-f648a4009ae44c0097b2ae4f8bfd09db.jpg)

![Life Insurance Companies in 2018 - Who are the best? [40 Reviews!] Life Insurance Companies In 2018 - Who Are The Best? [40 Reviews!]](https://www.lifeinsuranceblog.net/wp-content/uploads/2018/05/life-insurance-companies.jpg)

Link to this article: good life insurance companies.

See this topic for more details. good life insurance companies.

- 10 Best Life Insurance Companies of April 2024

- Here are the 7 best life insurance companies of April 2024 – CNBC

- Top 10 Life Insurance Companies In India April, 2024 – PolicyX

- 7 Best Whole Life Insurance Companies in April2024

- 10 Largest Car Insurance Companies in the U.S. 2024 – MarketWatch

- The Largest Life Insurance Companies | Bankrate

See more: https://kotop2.dienbienfriendlytrip.com/category/blog/