What is the face amount of a life insurance policy?

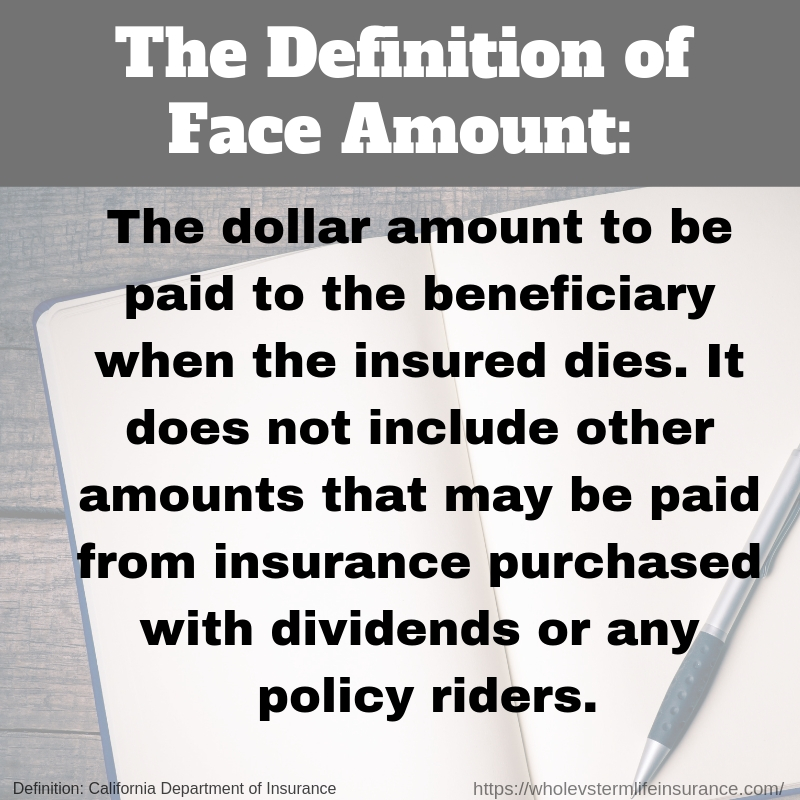

The face amount of a life insurance policy is the initial amount of coverage that the policyholder selects when purchasing the policy. It is the amount of money that will be paid out to the beneficiaries upon the death of the insured individual. This amount is specified in the policy and is agreed upon by the policyholder and the insurance company at the time of purchase.

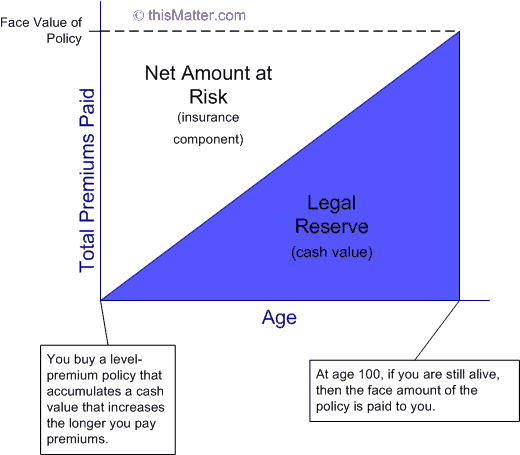

The face amount represents the total coverage that the policy provides and is usually paid out as a lump sum to the beneficiaries. It is important to note that the face amount is not the same as the cash value of the policy, which is the amount of money that can be accessed by the policyholder during their lifetime.

Life insurance face amount vs cash value

It’s important to distinguish between the face amount and the cash value of a life insurance policy. The face amount is the total amount of coverage that is paid out to beneficiaries upon the insured individual’s death, while the cash value is the amount of money that can be accessed by the policyholder during their lifetime.

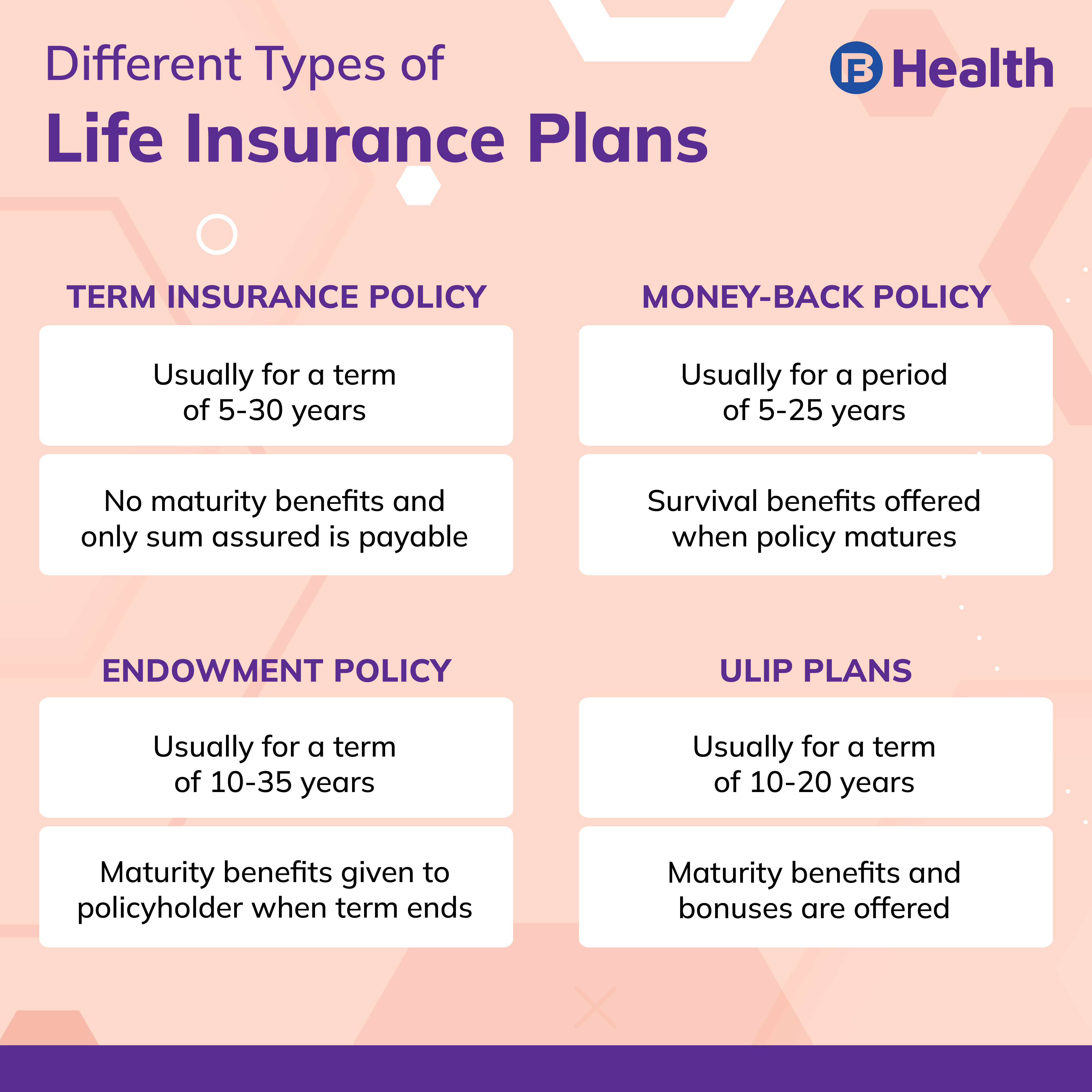

Cash value is a feature of certain types of life insurance policies, such as whole life insurance and universal life insurance. These policies have a cash value component that accumulates over time and can be used for a variety of purposes, such as taking out a loan against the policy or surrendering the policy for cash.

In contrast, term life insurance policies typically do not have a cash value component. These policies only provide coverage for a specified period of time, such as 10 or 20 years, and do not accumulate cash value.

Face amount of life insurance vs death benefit

The face amount of a life insurance policy is also known as the death benefit. When the insured individual passes away, the beneficiaries named in the policy will receive the face amount as a tax-free lump sum payment. This money can be used by the beneficiaries to cover funeral expenses, pay off debts, replace lost income, or any other financial needs they may have.

The death benefit is the primary purpose of life insurance – to provide financial protection for loved ones in the event of the insured individual’s death. It is important to ensure that the face amount of the policy is sufficient to meet the financial needs of the beneficiaries.

When is the face amount of a whole life policy paid?

The face amount of a whole life insurance policy is paid out to the beneficiaries upon the death of the insured individual. Whole life insurance is a type of permanent life insurance that provides coverage for the insured’s entire life, as long as the premiums are paid. The policy accumulates cash value over time, which can be accessed by the policyholder during their lifetime, but the primary purpose of the policy is to provide a death benefit to the beneficiaries.

When the insured individual passes away, the beneficiaries will receive the face amount of the policy as a tax-free lump sum payment. This money can be used to cover expenses such as funeral costs, outstanding debts, and financial support for the beneficiaries.

How to calculate face value of life insurance

The face amount of a life insurance policy is calculated based on a number of factors, including the age, health, and lifestyle of the insured individual, as well as the desired coverage amount. Insurance companies use actuarial tables and underwriting criteria to determine the appropriate face amount for a policyholder.

To calculate the face value of a life insurance policy, you can work with an insurance agent or use an online calculator provided by insurance companies. These tools will take into account your personal information and provide you with a recommended face amount for your policy.

When is the face amount paid under a joint life and survivor policy?

A joint life and survivor policy is a type of life insurance that covers two individuals, typically spouses. When one of the insured individuals passes away, the surviving spouse will receive the face amount of the policy as a tax-free lump sum payment. This money can be used to cover expenses such as funeral costs, outstanding debts, and financial support for the surviving spouse.

The face amount is paid out to the surviving spouse upon the death of the first insured individual, and the policy may continue to cover the surviving spouse until their death as well. Joint life and survivor policies are a way for couples to ensure that the surviving spouse is financially protected in the event of one spouse’s death.

Face amount insurance

Face amount insurance is another term for life insurance, specifically referring to the total coverage amount provided by the policy. The face amount is the initial amount of coverage that is agreed upon by the policyholder and the insurance company at the time of purchase.

Face amount insurance provides financial protection for loved ones in the event of the insured individual’s death. The beneficiaries will receive the face amount of the policy as a tax-free lump sum payment, which can be used to cover expenses such as funeral costs, outstanding debts, and financial support for the beneficiaries.

Minimum face amount life insurance

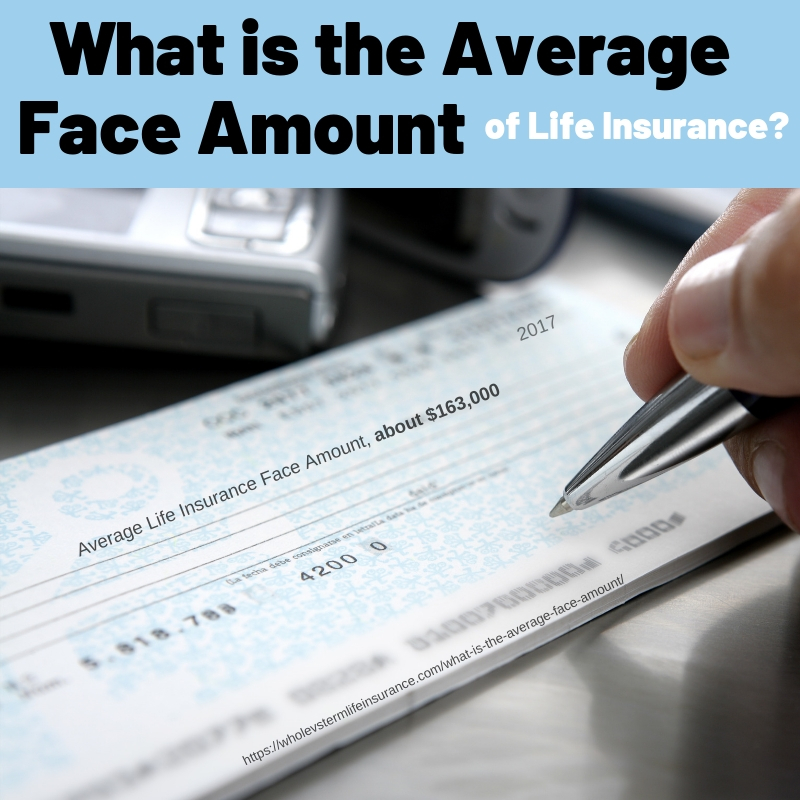

The minimum face amount for a life insurance policy can vary depending on the insurance company and the type of policy. Some insurance companies offer policies with face amounts as low as $10,000, while others may have minimum face amounts of $50,000 or more. It is important to choose a face amount that is sufficient to meet the financial needs of your beneficiaries in the event of your death.

What is face amount in accounting?

In accounting, the face amount of a life insurance policy is the total amount of coverage that is provided by the policy. This amount represents the death benefit that will be paid out to the beneficiaries upon the insured individual’s death. The face amount is a liability on the insurance company’s balance sheet, as it represents the potential payout that the company may have to make in the future.

In conclusion, the face amount of a life insurance policy is the total amount of coverage that is provided by the policy and is paid out to beneficiaries upon the death of the insured individual. It is important to select a face amount that is sufficient to meet the financial needs of your loved ones in the event of your passing. Understanding the face amount of your policy, along with other key concepts such as cash value and death benefit, will help you make informed decisions when it comes to life insurance.

FAQs

1. What is the difference between face amount and cash value in a life insurance policy?

The face amount is the total coverage amount provided by the policy and is paid out to beneficiaries upon the insured individual’s death. Cash value is the amount of money that can be accessed by the policyholder during their lifetime. Cash value only applies to certain types of policies, such as whole life and universal life insurance.

2. When is the face amount of a whole life policy paid?

The face amount of a whole life policy is paid out to the beneficiaries upon the insured individual’s death. Whole life insurance provides coverage for the insured’s entire life and accumulates cash value over time.

3. How is the face value of a life insurance policy calculated?

The face value of a life insurance policy is calculated based on factors such as the insured’s age, health, and desired coverage amount. Insurance companies use actuarial tables and underwriting criteria to determine the appropriate face amount for a policyholder.

4. What is the minimum face amount for a life insurance policy?

The minimum face amount for a life insurance policy can vary depending on the insurance company and the type of policy. Some companies offer policies with face amounts as low as $10,000, while others may require higher minimum face amounts.

5. When is the face amount paid under a joint life and survivor policy?

The face amount of a joint life and survivor policy is paid out to the surviving spouse upon the death of the first insured individual. The policy may continue to cover the surviving spouse until their death as well. Joint life and survivor policies are a way for couples to ensure that the surviving spouse is financially protected in the event of one spouse’s death.

What Does The Face Value On A Life Insurance Policy Mean? : Insurance Faqs

Keywords users search for: what is the face amount of a life insurance policy life insurance face amount vs cash value, face amount of life insurance vs death benefit, when is the face amount of a whole life policy paid, how to calculate face value of life insurance, when is the face amount paid under a joint life and survivor policy, face amount insurance, minimum face amount life insurance, what is face amount in accounting

Images on topic what is the face amount of a life insurance policy

Category: Top 76 What Is The Face Amount Of A Life Insurance Policy

Read more here: kotop2.dienbienfriendlytrip.com

Link to this article: what is the face amount of a life insurance policy.

See this topic for more details. what is the face amount of a life insurance policy.

- What Is the Face Amount of a Life Insurance Policy? (2024 …

- What Is the Face Value of a Life Insurance Policy – Investopedia

- CHAPTER 4 LIFE INSURANCE Flashcards – Quizlet

- Face Value: Definition in Finance, Comparison With Market Value

- FAQs – Sun Life Philippines

- Face Amount of Life Insurance | Aflac

See more: https://kotop2.dienbienfriendlytrip.com/category/blog/