Life Insurance Face Amount vs Cash Value

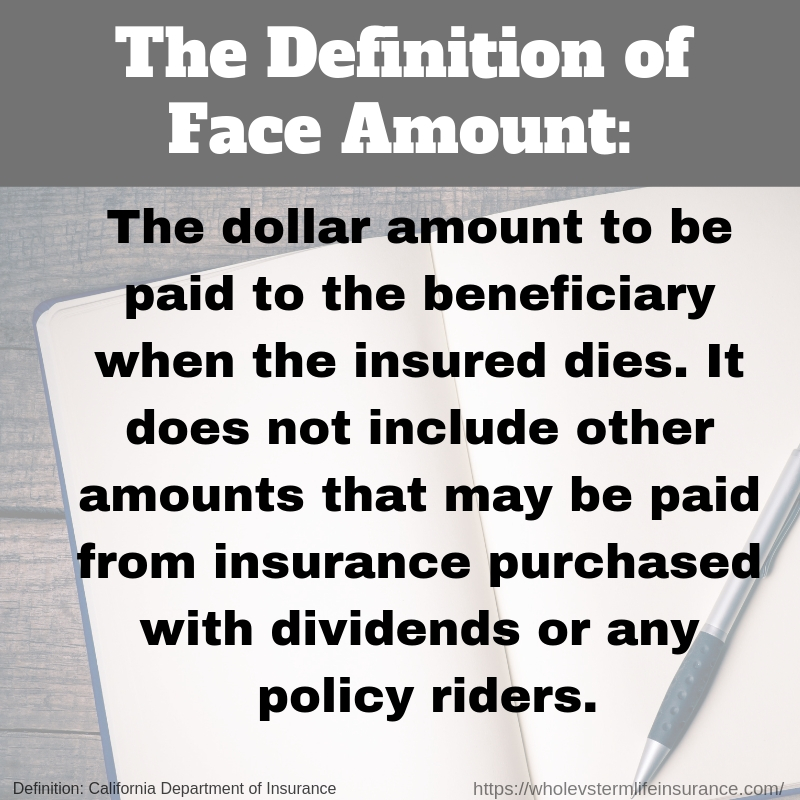

The face amount of a life insurance policy is the amount of coverage that is selected by the policyholder. It is the sum that will be paid out to the beneficiary of the policy when the insured individual dies. This amount does not change over the life of the policy unless additional coverage is purchased or the policyholder requests a change in coverage. The face amount remains constant regardless of the cash value of the policy.

The cash value of a life insurance policy, on the other hand, is the amount of money that has accumulated in the policy over time. This cash value can be accessed by the policyholder through withdrawals or loans while the insured individual is still alive. The cash value grows over time based on the performance of the investments within the policy. The cash value is separate from the face amount of the policy and does not affect the amount that will be paid out to the beneficiary upon the insured individual’s death.

Minimum Face Amount Life Insurance

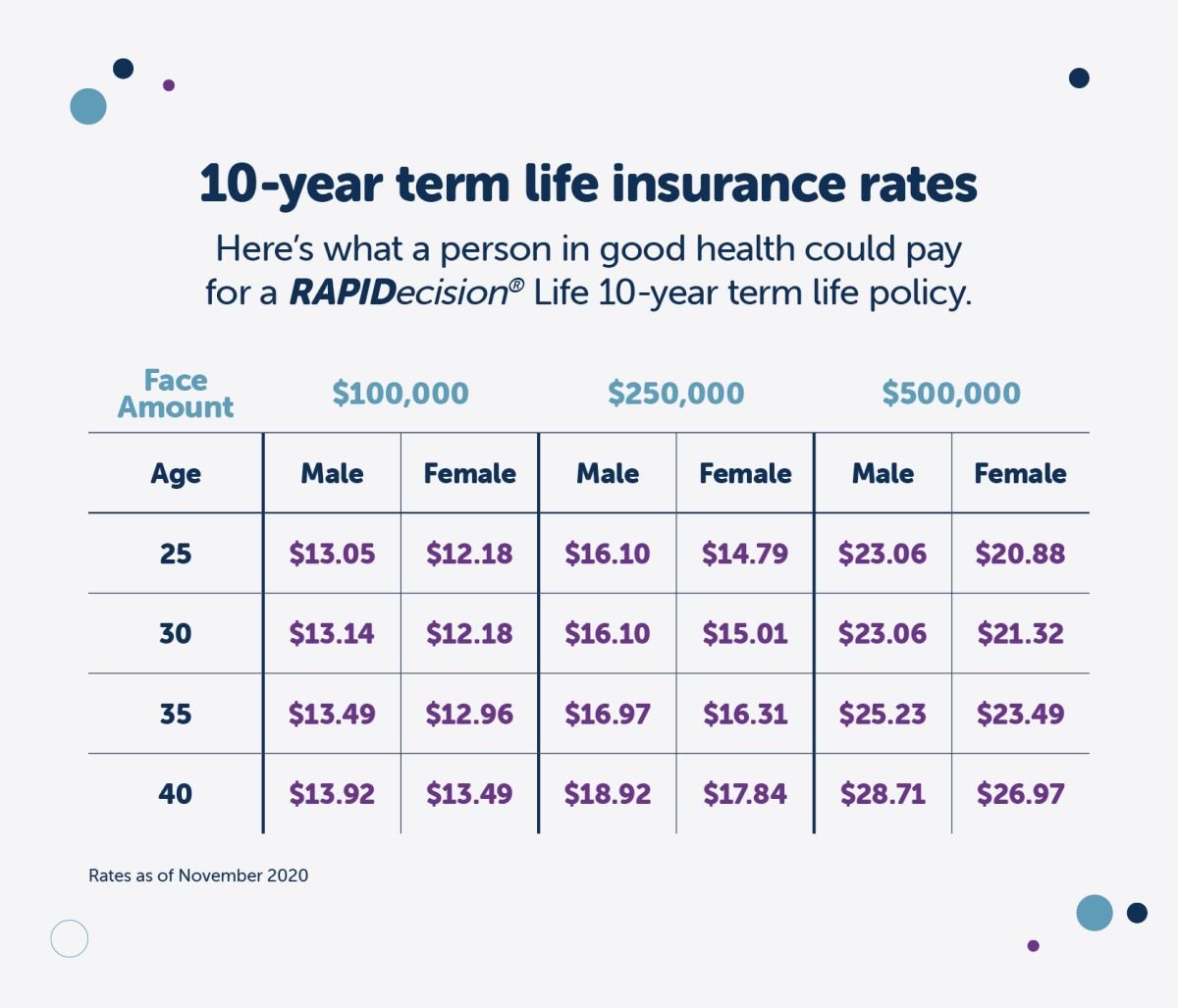

The minimum face amount for a life insurance policy can vary depending on the insurance company and the type of policy being purchased. However, most insurance companies offer policies with face amounts starting at $50,000. Some companies may offer policies with lower face amounts, but it is important to consider the coverage needs of the insured individual and their beneficiaries when selecting a face amount for a policy.

Face Amount of Life Insurance vs Death Benefit

The face amount of a life insurance policy is the amount of coverage that is selected by the policyholder. This is the sum that will be paid out to the beneficiary of the policy when the insured individual passes away. The death benefit of a life insurance policy is the total amount that is paid out to the beneficiary upon the insured individual’s death. This includes the face amount of the policy as well as any additional benefits or riders that may be included in the policy.

Face Amount Insurance

Face amount insurance is another term for the coverage amount selected by the policyholder when purchasing a life insurance policy. This is the sum that will be paid out to the beneficiary of the policy when the insured individual passes away. Face amount insurance is a crucial factor to consider when selecting a life insurance policy as it determines the financial protection that will be provided to the insured individual’s loved ones in the event of their death.

How to Calculate Face Value of Life Insurance

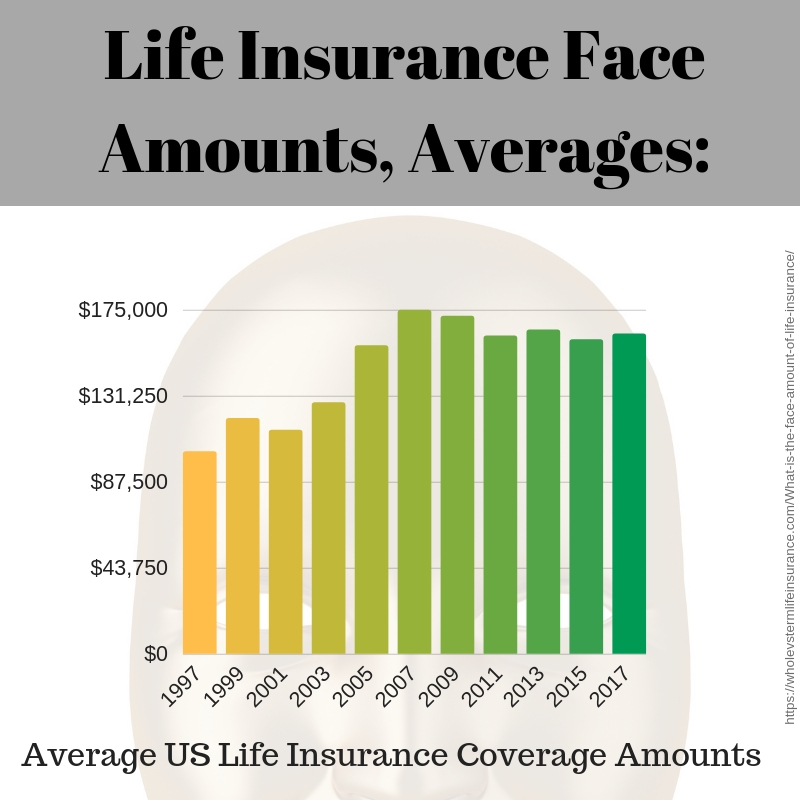

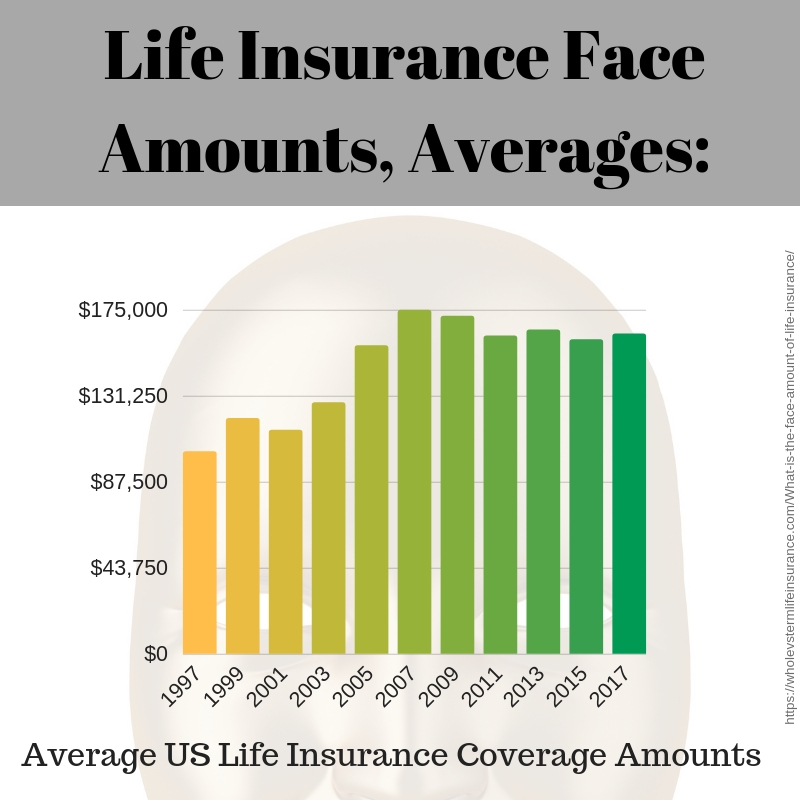

The face value of a life insurance policy is typically calculated based on the financial needs of the insured individual and their beneficiaries. When determining the face value of a policy, it is important to consider factors such as the insured individual’s income, outstanding debts, future financial obligations, and any additional expenses that may arise upon their death. Insurance companies may also take into account the insured individual’s age, health, and lifestyle when calculating the face value of a policy.

Face Amount Meaning

The face amount of a life insurance policy is the amount of coverage that is selected by the policyholder. This is the sum that will be paid out to the beneficiary of the policy when the insured individual passes away. The face amount is a crucial aspect of a life insurance policy as it determines the financial protection that will be provided to the insured individual’s loved ones in the event of their death. It is important to carefully consider the face amount of a policy to ensure that it meets the financial needs of the insured individual and their beneficiaries.

What is the Cash Value of a Life Insurance Policy

The cash value of a life insurance policy is the amount of money that has accumulated in the policy over time. This cash value can be accessed by the policyholder through withdrawals or loans while the insured individual is still alive. The cash value grows over time based on the performance of the investments within the policy. The cash value is separate from the face amount of the policy and does not affect the amount that will be paid out to the beneficiary upon the insured individual’s death.

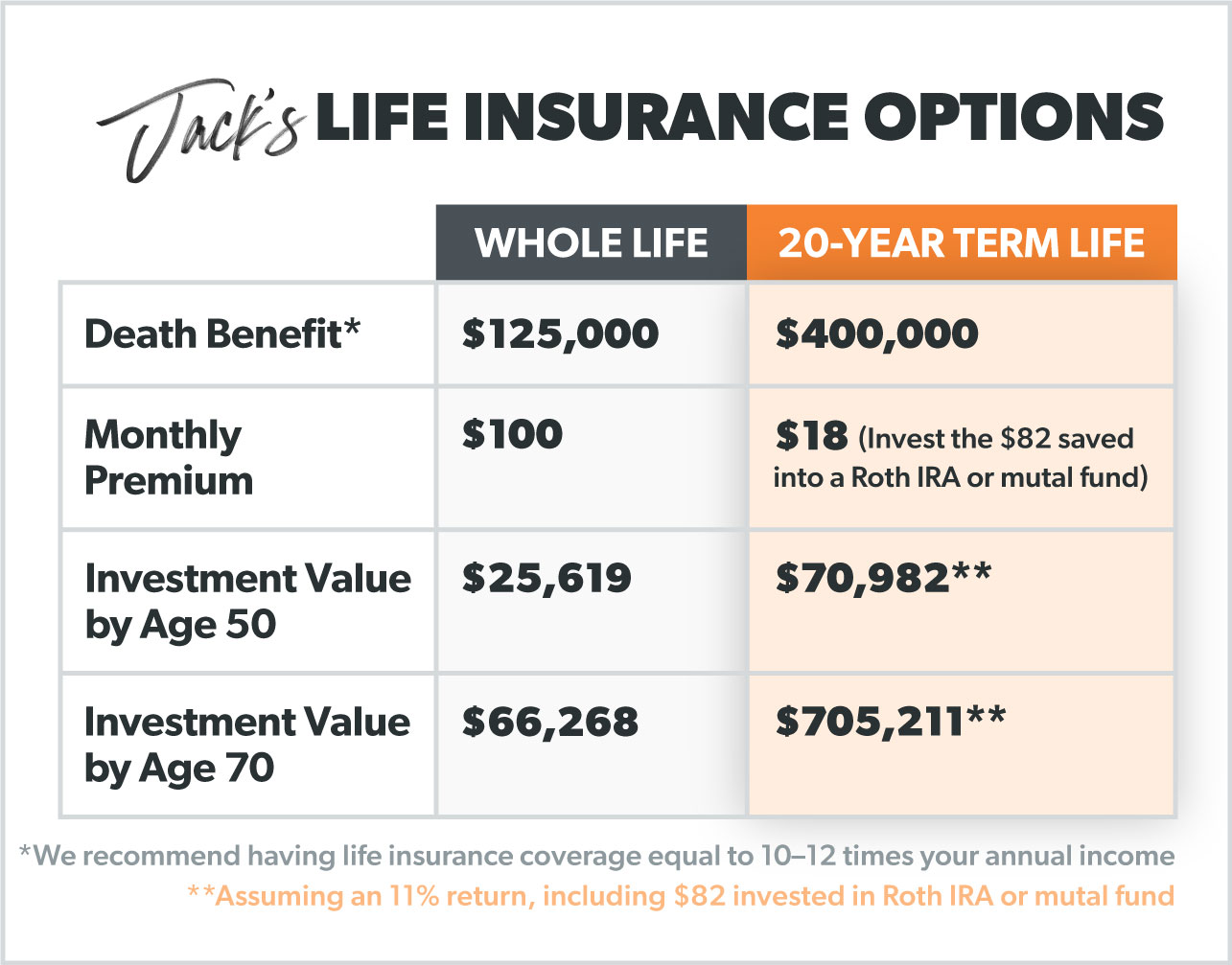

When is the Face Amount of a Whole Life Policy Paid

The face amount of a whole life insurance policy is paid out to the beneficiary upon the insured individual’s death. Whole life insurance policies provide coverage for the entire life of the insured individual as long as the premiums are paid. When the insured individual passes away, the face amount of the policy is paid out to the beneficiary, providing a financial safety net for their loved ones.

FAQs

1. Can I change the face amount of my life insurance policy?

Yes, you can typically change the face amount of your life insurance policy by contacting your insurance company or agent. However, there may be certain restrictions or guidelines in place for changing the face amount of your policy, so it is important to consult with your insurance provider before making any changes.

2. Is the face amount of a life insurance policy taxable?

The face amount of a life insurance policy is typically not taxable to the beneficiary upon payout. Life insurance death benefits are generally considered tax-free income, providing a financial benefit to the beneficiary without any tax implications.

3. How do I know if the face amount of my life insurance policy is sufficient?

To determine if the face amount of your life insurance policy is sufficient, it is important to consider factors such as your income, outstanding debts, future financial obligations, and any additional expenses that may arise upon your death. Consulting with a financial advisor or insurance professional can help you assess your coverage needs and ensure that your policy provides adequate protection for your loved ones.

4. What is the difference between face amount and death benefit in a life insurance policy?

The face amount of a life insurance policy is the amount of coverage that is selected by the policyholder, while the death benefit is the total amount that is paid out to the beneficiary upon the insured individual’s death. The death benefit includes the face amount of the policy as well as any additional benefits or riders that may be included in the policy.

5. Can I access the face amount of my life insurance policy while I am still alive?

No, the face amount of a life insurance policy cannot be accessed by the insured individual while they are still alive. The face amount is paid out to the beneficiary upon the insured individual’s death, providing a financial safety net for their loved ones.

In conclusion, the face amount of a life insurance policy is the amount of coverage selected by the policyholder that will be paid out to the beneficiary upon the insured individual’s death. It is essential to understand the difference between the face amount and cash value of a policy, as well as the factors to consider when determining the face value of a policy. By carefully selecting a face amount that meets the financial needs of the insured individual and their beneficiaries, a life insurance policy can provide valuable protection and peace of mind for the future.

What Does The Face Value On A Life Insurance Policy Mean? : Insurance Faqs

Keywords users search for: life insurance face amount life insurance face amount vs cash value, minimum face amount life insurance, face amount of life insurance vs death benefit, face amount insurance, how to calculate face value of life insurance, face amount meaning, what is the cash value of a life insurance policy, when is the face amount of a whole life policy paid

Images on topic life insurance face amount

Category: Top 79 Life Insurance Face Amount

Read more here: kotop2.dienbienfriendlytrip.com

Link to this article: life insurance face amount.

See this topic for more details. life insurance face amount.

- What Is the Face Amount of a Life Insurance Policy? (2024 …

- What Is the Face Value of a Life Insurance Policy

- Face Amount of Life Insurance

- What Is the Life Insurance Face Amount?

- What Is the Face Value of Life Insurance?

- What is the face amount of a life insurance policy?

See more: https://kotop2.dienbienfriendlytrip.com/category/blog/