City of Fort Worth Life Insurance:

The City of Fort Worth offers life insurance coverage to its employees as part of their benefits package. This coverage typically includes a death benefit that is paid out to the beneficiary designated by the employee in the event of their passing. Employees may also have the option to purchase additional coverage through the city’s group plan at competitive rates.

City of Fort Worth life insurance provides financial protection to employees and their families, helping to cover expenses such as funeral costs, mortgage payments, and childcare in the event of a tragedy. Having this coverage can provide peace of mind and ensure that loved ones are taken care of financially during a difficult time.

Fort Worth Health Insurance:

In addition to life insurance, residents of Fort Worth have access to a variety of health insurance options to help cover medical expenses. Whether through an employer-sponsored plan, individual market coverage, or government programs like Medicaid or Medicare, having health insurance is essential for maintaining overall well-being and financial security.

Fort Worth health insurance can help protect individuals and families from the high costs of medical care, including doctor’s visits, prescription medications, hospital stays, and more. By having health insurance coverage, individuals can access the care they need without worrying about the financial burden it may place on them.

Beneplace City of Fort Worth:

Beneplace is a marketplace that offers discounts on a variety of products and services to employees of participating organizations, including the City of Fort Worth. Through Beneplace, employees can access exclusive deals on everything from electronics and travel to insurance and financial services.

One of the benefits available through Beneplace is discounted life insurance coverage, which can help employees save money on premiums while still receiving quality protection for themselves and their families. By taking advantage of these discounts, employees can maximize their benefits and ensure they have the coverage they need at an affordable price.

City of Fort Worth Retiree Health Insurance:

For retirees of the City of Fort Worth, maintaining health insurance coverage is essential to ensuring continued access to medical care in their golden years. Retiree health insurance plans offered by the city can help bridge the gap between employer-sponsored coverage and Medicare, providing peace of mind and financial security for retirees.

City of Fort Worth retiree health insurance plans typically offer a range of coverage options, including medical, dental, and vision benefits. Retirees can choose the plan that best meets their needs and budget, helping to ensure they have access to the care they need without breaking the bank.

Surgery Plus City of Fort Worth:

Surgery Plus is a program offered by the City of Fort Worth that provides employees with access to high-quality surgical services at an affordable cost. Through Surgery Plus, employees can receive top-notch surgical care from experienced providers in the Fort Worth area, helping to ensure they get the treatment they need without the high price tag.

City of Fort Worth Paid Holidays Life Insurance:

In addition to life insurance coverage, the City of Fort Worth offers paid holidays to its employees as part of their benefits package. Paid holidays provide employees with time off to spend with family and friends, relax, and rejuvenate, all while still receiving their regular pay.

FAQs:

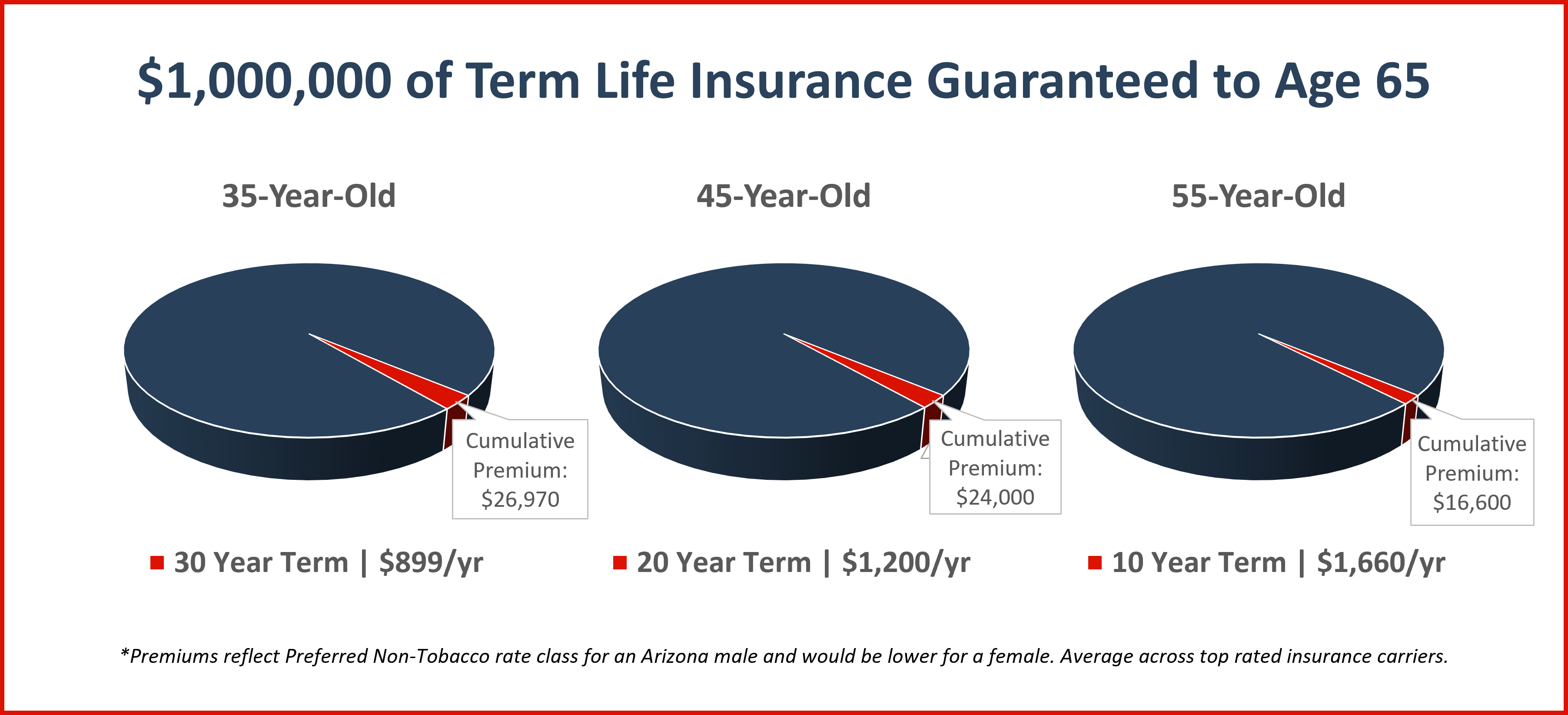

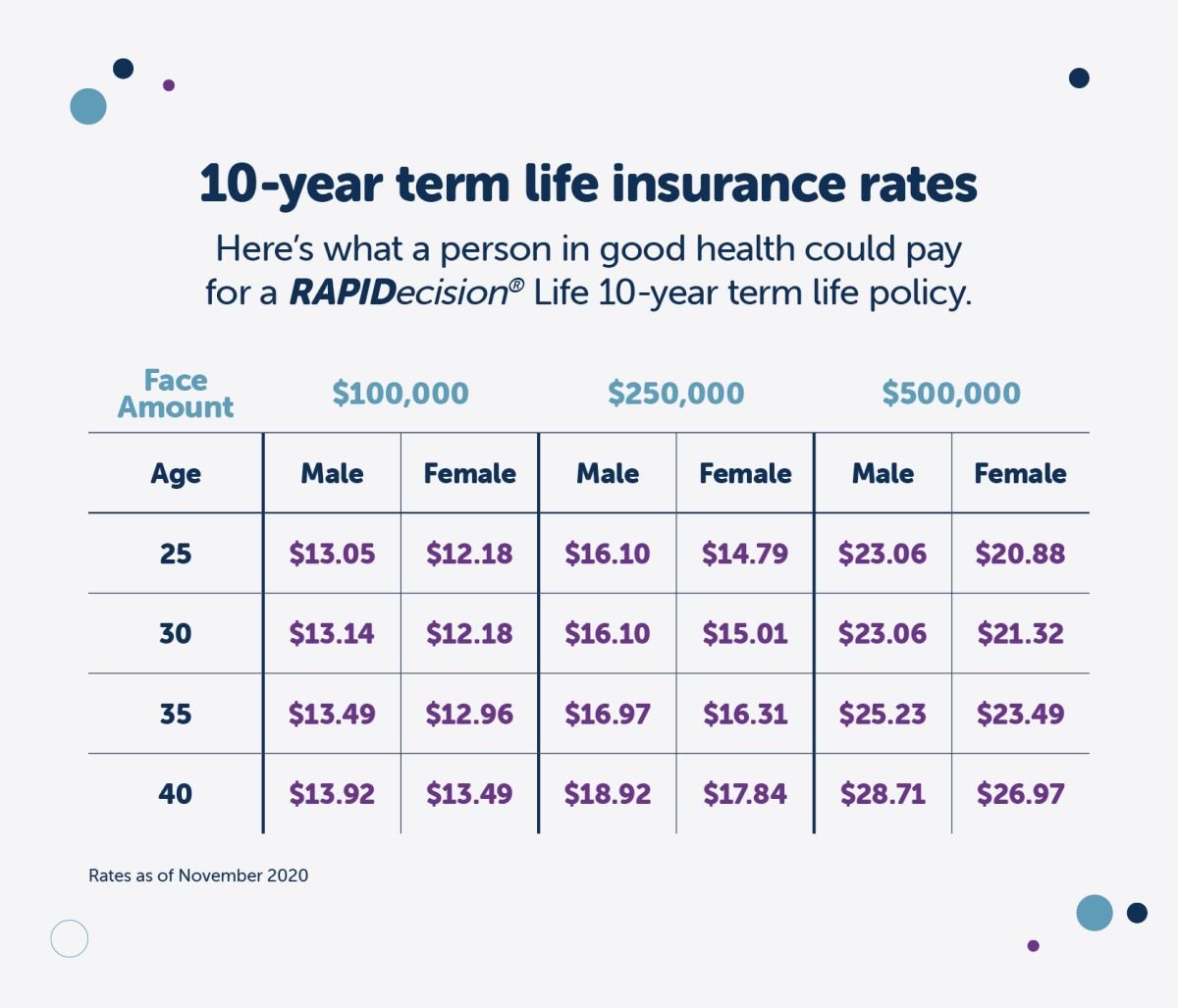

Q: What is the difference between term life insurance and whole life insurance?

A: Term life insurance provides coverage for a specific period, while whole life insurance covers you for your entire life and includes a cash value component.

Q: How much life insurance coverage do I need?

A: The amount of life insurance coverage you need depends on factors such as your income, expenses, debts, and financial goals. It’s recommended to have coverage equal to at least 10 times your annual income.

Q: Can I purchase life insurance outside of my employer’s plan?

A: Yes, you can purchase life insurance coverage on the individual market through insurance companies or brokers. It’s important to compare rates and coverage options to find the best policy for your needs.

Q: How do I enroll in City of Fort Worth health insurance or life insurance plans?

A: Employees can typically enroll in health insurance and life insurance plans during open enrollment periods or when they first become eligible for benefits. Contact your employer’s HR department for more information on enrollment procedures.

In conclusion, life insurance is an essential part of financial planning that provides security and protection for individuals and their families. In Fort Worth, residents have access to a variety of options for life insurance coverage, including through the city’s own programs like City of Fort Worth life insurance, Fort Worth health insurance, Beneplace City of Fort Worth, City of Fort Worth retiree health insurance, Surgery Plus City of Fort Worth, and City of Fort Worth paid holidays life insurance. By exploring these options and understanding the benefits they offer, individuals can make informed choices to provide financial security for themselves and their loved ones in the years to come.

How Does Life Insurance Work?

Keywords users search for: life insurance ft worth city of fort worth life insurance, fort worth health insurance, beneplace city of fort worth, city of fort worth retiree health insurance, surgery plus city of fort worth, city of fort worth paid holidays

Images on topic life insurance ft worth

Category: Top 58 Life Insurance Ft Worth

Read more here: kotop2.dienbienfriendlytrip.com

:max_bytes(150000):strip_icc()/How-can-i-borrow-money-my-life-insurance-policy_final-fa1474645da94b368bb3f5452392b0c0.png)

Link to this article: life insurance ft worth.

See this topic for more details. life insurance ft worth.

- Average Life Insurance Rates for April 2024 – NerdWallet

- How Life Insurance Can Help You Build Wealth

- Is term life insurance worth it? Here’s what experts say – CBS News

- Different Types of Life Insurance | Progressive

- How Much Is A $500000 Life Insurance Policy? – Forbes

- Average Whole Life Insurance Rates (April 2024) – Policygenius

See more: https://kotop2.dienbienfriendlytrip.com/category/blog/